What is Business Credit?

Welcome to Musicnomics and the wonderful world of business credit! Despite the many differences between business and personal credit, there are multiple similarities. Business credit, also known as commercial credit, is defined by Investopedia as follows:

“A number indicating whether a company is a good candidate to lend money to or do business with. Business credit scores, also called commercial credit scores, are based on a company’s credit obligations and repayment histories with lenders and suppliers; any legal filings such as tax liens, judgments or bankruptcies; how long the company has operated; business type and size; and repayment performance relative to that of similar companies.”

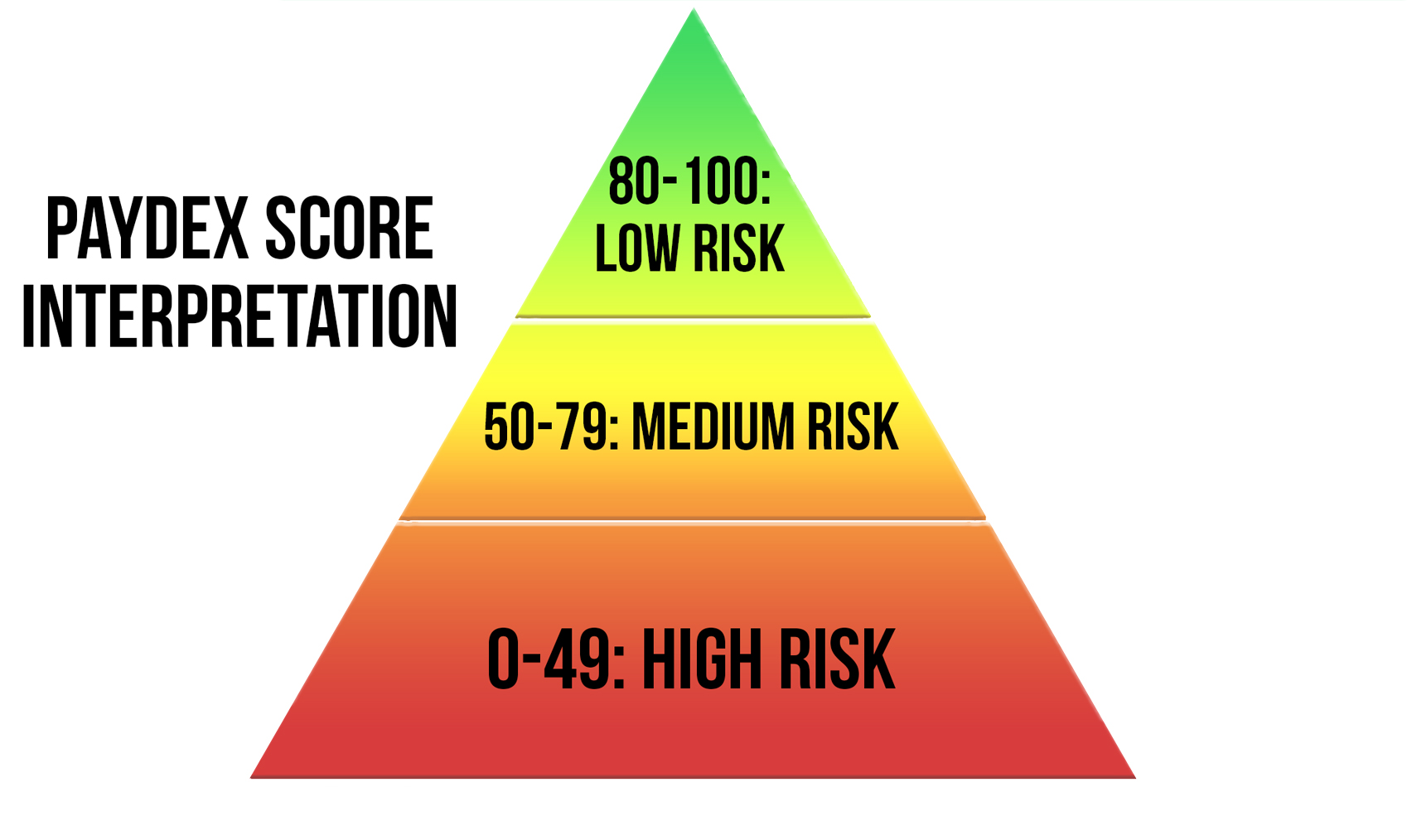

Unlike a personal credit score, with a range of 300 and 850, business credit is scored on a 0 to 100 scale. Just the same as personal credit, the higher the score, the lower the lending risk. As an individual, you thrive to push your score as close to 850 as possible. As a business owner, 100 is the magic number.

The Art of Business Credit & Music Artists.

There are many creative ways for an artist to create a budget to grow their brand. One of the best long term financial solutions for an artist to secure the funding they need is to have a company and build strong business credit to have access to capital.

Business credit also known as corporate credit is separate from your personal credit and gives you the opportunity to borrow money and secure lines of credit through your company without a personal guarantee.

Here are just a few examples of the types of funding resources an artist can obtain through their own company and utilize to advance their music career.

- Access High-Limit Business credit cards

- Access High-Limit Store credit cards

- Secure business loans

- Secure business lines of credit

- Unsecured No-Doc, 0% Financing

- Business Vendor Accounts

- Auto Vehicle financing with no personal guarantee

- Get business loans with rates of 5% and less